Altcoin Exit Strategies: When to Sell and Maximize Profits

Altcoin exit strategies are crucial for investors navigating the volatile cryptocurrency market, requiring strategic decisions on when to sell and secure profits amidst rapid market changes.

Navigating the altcoin market requires more than just picking the right coins; it demands a strategic approach to exiting positions at the right time. Understanding altcoin exit strategies is crucial for securing profits and minimizing losses in this rapidly evolving landscape.

Understanding the Altcoin Market’s Volatility

The altcoin market is known for its high volatility, a characteristic that presents both opportunities and risks for investors. Understanding this volatility is key to developing effective exit strategies.

Factors Contributing to Volatility

Several factors influence the volatility of altcoins, including market sentiment, regulatory news, technological advancements, and overall cryptocurrency adoption rates.

- Market Sentiment: Positive or negative news can quickly impact investor confidence and trading activity.

- Regulatory News: Announcements from governments about cryptocurrency regulation can cause significant price swings.

- Technological Advancements: New developments or upgrades in blockchain technology can affect the perceived value of altcoins.

- Adoption Rates: The level of adoption and real-world use cases for an altcoin can impact its long-term stability.

Recognizing these factors allows investors to anticipate potential market movements and adjust their exit strategies accordingly. By staying informed and monitoring market trends, investors can make more informed decisions about when to sell their altcoins.

Understanding the inherent volatility of the altcoin market is the first step in crafting a robust exit strategy. By identifying the factors that drive market fluctuations, investors can better prepare for potential price swings and make informed decisions to protect their investments.

Defining Your Investment Goals and Risk Tolerance

Before investing in altcoins, it’s essential to define your investment goals and understand your risk tolerance. This understanding serves as the foundation for crafting effective exit strategies.

Setting Realistic Investment Goals

Determine your specific objectives, such as short-term gains, long-term growth, or diversification of your portfolio. These goals will influence your approach to buying and selling altcoins.

Establishing clear objectives ensures that you remain focused and objective during market fluctuations, avoiding emotional decisions driven by fear or greed.

Assessing Your Risk Tolerance

Evaluate how much risk you are willing to take with your investments. This involves understanding your comfort level with potential losses and your ability to handle market volatility.

Knowing your risk tolerance helps you determine appropriate position sizes and set realistic profit targets that align with your financial circumstances. By aligning your investments with your risk tolerance, you can minimize stress and maintain a balanced investment portfolio.

Defining your investment goals and accurately assessing your risk tolerance is crucial for creating an effective exit strategy. This self-awareness will guide your decisions, help you stay disciplined, and ultimately improve your chances of achieving your financial objectives in the altcoin market.

Technical Analysis for Spotting Sell Signals

Technical analysis is a valuable tool for identifying potential sell signals in the altcoin market. By studying price charts and technical indicators, investors can gain insights into market trends and make informed decisions about when to exit their positions.

Key Technical Indicators

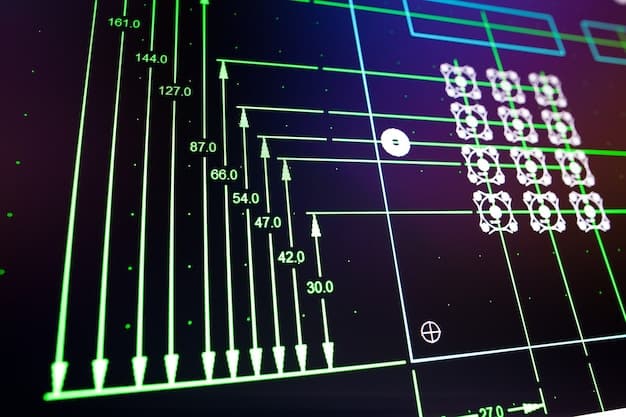

Several technical indicators can help identify potential sell signals, including moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

- Moving Averages: These indicators smooth out price data to identify trends. A bearish crossover, where a short-term moving average crosses below a long-term moving average, can signal a potential sell-off.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often indicates an overbought condition, suggesting a potential price correction.

- Moving Average Convergence Divergence (MACD): The MACD identifies changes in the strength, direction, momentum, and duration of a trend in a stock’s price. A bearish crossover in the MACD can signal a potential downtrend.

Analyzing these indicators in combination can provide a more comprehensive view of market conditions and improve the accuracy of sell signals. However, it’s essential to remember that technical analysis is not foolproof, and indicators should be used in conjunction with other forms of analysis.

Technical analysis provides crucial insights for recognizing potential sell signals in the altcoin market. By understanding and applying key technical indicators, investors can enhance their ability to time their exits effectively and protect their profits.

Fundamental Analysis and Market Sentiment

Fundamental analysis and market sentiment are critical components of a comprehensive altcoin exit strategy. Evaluating the underlying fundamentals of a project and gauging market sentiment can provide valuable insights into its long-term prospects.

Assessing the Project’s Fundamentals

Research the project’s whitepaper, team, technology, and use cases to determine its long-term viability. Look for projects with strong fundamentals and real-world applications.

A solid fundamental analysis can help you identify altcoins with the potential for sustainable growth, reducing the risk of investing in projects with little substance.

Monitoring Market Sentiment

Keep an eye on news, social media, and online forums to gauge overall market sentiment towards a particular altcoin. Positive sentiment can drive prices higher, while negative sentiment can lead to sell-offs.

Staying informed about market sentiment can help you anticipate potential price movements and adjust your exit strategy accordingly. However, it’s important to distinguish between genuine sentiment and hype, as hype-driven rallies can be unsustainable.

Combining fundamental analysis with market sentiment analysis offers a well-rounded approach to decision-making. By carefully evaluating a project’s underlying value and the prevailing market mood, investors can make more informed decisions about when to exit their positions.

Implementing Stop-Loss Orders to Minimize Losses

Stop-loss orders are an essential tool for managing risk and minimizing potential losses in the altcoin market. These orders automatically sell your altcoins if the price drops to a predefined level.

Setting Appropriate Stop-Loss Levels

Determine appropriate stop-loss levels based on your risk tolerance, investment goals, and the volatility of the altcoin. A common strategy is to set stop-loss levels below key support levels or recent lows.

- Risk Tolerance: Lower risk tolerance may warrant tighter stop-loss levels, while higher risk tolerance may allow for wider stop-loss levels.

- Investment Goals: Short-term traders may use tighter stop-loss levels than long-term investors.

- Volatility: More volatile altcoins may require wider stop-loss levels to avoid being prematurely triggered by minor price fluctuations.

Setting appropriate stop-loss levels is crucial for protecting your capital without unnecessarily exiting profitable positions. Regularly review and adjust your stop-loss levels as market conditions change.

Using stop-loss orders effectively is a key risk management strategy in the altcoin market. By setting predetermined exit points, investors can limit potential losses and preserve their capital in the face of market downturns.

Dollar-Cost Averaging (DCA) Out of Positions

Dollar-cost averaging (DCA) involves selling a fixed dollar amount of your altcoins at regular intervals, regardless of the price. This strategy can help reduce the impact of volatility on your exit price.

Benefits of DCA

DCA can help you avoid the pitfall of trying to time the market perfectly. By spreading out your sales over time, you can capture an average selling price that mitigates the risk of selling all your altcoins at a low point.

DCA is particularly useful in volatile markets, where prices can fluctuate dramatically in short periods. This strategy can help manage emotional decision-making and ensure a more consistent exit process.

Implementing a DCA Strategy

Determine the total value of altcoins you want to sell and the timeframe over which you want to sell them. Then, divide the total value by the number of intervals to determine the amount to sell at each interval.

For example, if you want to sell $10,000 worth of altcoins over 10 weeks, you would sell $1,000 worth of altcoins each week. By consistently executing your DCA plan, you can gradually exit your positions and minimize the impact of market fluctuations.

DCA offers a systematic approach to exiting altcoin positions, reducing the stress and uncertainty associated with market timing. By selling at regular intervals, investors can achieve a more stable and predictable exit price.

| Key Point | Brief Description |

|---|---|

| 📊 Market Volatility | Understanding factors like sentiment and regulation impacts exit strategies. |

| 🎯 Investment Goals | Defining goals and risk tolerance guides your exit decisions. |

| 📉 Stop-Loss Orders | Using stop-loss orders helps to minimize losses and protect capital. |

| 💰 Dollar-Cost Averaging | DCA out of positions to mitigate the risk of selling at a low point. |

FAQ

An altcoin exit strategy is a predefined plan for selling your altcoins to secure profits or minimize losses, based on market conditions and investment goals.

An exit strategy helps you avoid emotional decision-making and ensures you have a plan in place to protect your investments in the volatile altcoin market.

Technical analysis uses price charts and indicators to identify potential sell signals, helping you time your exits more effectively based on market trends.

Stop-loss orders automatically sell your altcoins when the price drops to a predetermined level, limiting your potential losses during market downturns.

DCA involves selling a fixed amount of altcoins at regular intervals, mitigating the risk of selling all your coins at a low point and stabilizing your exit price.

Conclusion

Developing and implementing effective altcoin exit strategies is essential for navigating the cryptocurrency market’s volatility and achieving your investment goals. By understanding market dynamics, setting clear objectives, utilizing technical and fundamental analysis, and employing risk management tools like stop-loss orders and DCA, investors can confidently secure profits and minimize losses in the ever-changing altcoin landscape.