DeFi Flash Loans 2026: Profit from Instant Liquidity

DeFi flash loans in 2026 enable users to borrow uncollateralized assets instantly, execute profitable strategies like arbitrage or liquidations, and repay within the same transaction, often yielding significant net profits.

In the rapidly evolving landscape of decentralized finance, Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit has become a crucial skill for advanced crypto enthusiasts. This innovative financial primitive allows users to borrow vast sums of cryptocurrency without any upfront collateral, provided the loan is repaid within the very same blockchain transaction. Imagine the possibilities: executing complex arbitrage, facilitating liquidations, or even performing self-liquidating loans, all powered by instant liquidity. This guide will delve into the intricacies of flash loans, offering a roadmap to harness their power for substantial gains in the coming year.

Understanding the Mechanics of DeFi Flash Loans

DeFi flash loans represent one of the most sophisticated and powerful tools within decentralized finance. At their core, they are uncollateralized loans that must be borrowed and repaid within a single, atomic blockchain transaction. This ‘atomicity’ is key, meaning the entire operation either succeeds completely or fails entirely, ensuring no risk to the lender if the borrower cannot repay. This unique characteristic is what allows for the lending of significant capital without traditional collateral requirements.

The concept hinges on smart contract logic. When a flash loan is initiated, the smart contract first loans the assets to the borrower. The borrower then executes a series of predefined operations within the same transaction block. If, by the end of these operations, the original loan amount plus a small fee is not returned to the lending protocol, the entire transaction is automatically reversed, as if it never happened. This built-in security mechanism is what makes flash loans possible and safe for lenders, while opening up unprecedented opportunities for borrowers.

The Atomic Transaction Principle

- No Collateral Required: Unlike traditional DeFi loans, flash loans do not demand any upfront collateral, making them accessible to a wider range of users.

- Single Transaction Execution: The entire borrow-execute-repay cycle must occur within one blockchain transaction, ensuring immediate settlement and risk mitigation.

- Automatic Reversion: If repayment fails for any reason, the smart contract automatically reverts all state changes, protecting the lender’s funds.

The implications of this atomic principle are profound. It transforms the way capital can be utilized in DeFi, enabling strategies that would be impossible with traditional, time-separated loans. Users can access millions in liquidity for mere seconds, leveraging it to exploit market inefficiencies or manage complex financial positions. This instantaneous access to capital, coupled with the security of atomic transactions, positions flash loans as a cornerstone of advanced DeFi strategies in 2026.

Identifying Profitable Opportunities in 2026

The ability to secure instant liquidity opens up a myriad of profitable avenues for those adept at Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit. Identifying these opportunities requires a keen understanding of market dynamics, protocol functionalities, and the ability to execute complex operations quickly. The most common and often lucrative strategies involve arbitrage, liquidation, and collateral swapping.

Arbitrage remains a prime target for flash loan users. This involves exploiting price discrepancies for the same asset across different decentralized exchanges (DEXs). With a flash loan, one can borrow a large sum of an asset from one protocol, sell it on a DEX where its price is higher, and then buy it back on another DEX where it’s cheaper, repaying the loan and pocketing the difference, all within seconds. The speed and scale of flash loans amplify these small price differences into significant profits.

Key Profit Strategies

- Decentralized Arbitrage: Capitalizing on price differences of the same asset across various DEXs. This requires low latency and efficient smart contract execution.

- Collateral Swapping/Refinancing: Users can use a flash loan to temporarily pay off an existing loan, swap their collateral for a more favorable asset, and then re-borrow against the new collateral. This can reduce interest rates or unlock higher loan-to-value ratios.

- Liquidations: In certain lending protocols, users can use a flash loan to repay an undercollateralized loan, take possession of the collateral at a discount, and then sell it on the market, paying back the flash loan and keeping the profit.

Beyond these core strategies, the evolving DeFi landscape in 2026 is likely to present new and innovative opportunities. As new protocols emerge and existing ones integrate more complex functionalities, the potential for creative flash loan applications will expand. Staying updated on protocol developments and market trends is essential for identifying these emerging profit windows.

Prerequisites and Technical Setup for Flash Loans

While the allure of instant profits is strong, Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit demands a solid technical foundation and careful preparation. Flash loans are not typically executed through simple user interfaces but rather through custom smart contracts or specialized bots. This means a basic understanding of Solidity programming and blockchain interaction is highly beneficial, if not essential, for direct involvement.

The primary prerequisite is a development environment. This usually involves setting up tools like Hardhat or Truffle for smart contract development and testing. Access to a reliable blockchain node (e.g., via Infura or Alchemy) is also crucial for deploying and interacting with your contracts. For those less inclined to code, platforms offering ‘flash loan as a service’ or visual builders might emerge more prominently by 2026, though they may come with higher fees or less flexibility.

Essential Technical Components

- Smart Contract Development Skills: Proficiency in Solidity is vital for writing the logic that borrows, executes, and repays the flash loan.

- Development Environment: Tools like Hardhat or Truffle facilitate testing and deployment of your flash loan contract.

- Access to Blockchain Nodes: Reliable connections to the blockchain (e.g., Ethereum, Polygon, Arbitrum) are necessary for transaction execution.

- Gas Optimization: Flash loan transactions must be highly gas-efficient, as they are often time-sensitive and involve multiple internal calls.

Thorough testing of your smart contract logic on a testnet is paramount before deploying to the mainnet. Even a minor bug can lead to significant losses, as the atomic nature of flash loans means there’s no opportunity to manually intervene if something goes wrong. A well-tested, optimized contract is your best defense against potential pitfalls and ensures smooth execution of your profitable strategies.

Step-by-Step Execution of a Flash Loan Strategy

Executing a flash loan successfully requires meticulous planning and precise coding. This section breaks down the general steps involved in leveraging a flash loan for profit, especially when Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit is the goal. While specific implementations vary based on the chosen strategy, the underlying flow remains consistent.

The first step involves identifying a profitable opportunity. This could be an arbitrage opportunity between two DEXs, a liquidation target on a lending platform, or a beneficial collateral swap. Once identified, the next crucial step is to write a smart contract that encapsulates the entire sequence of operations. This contract will handle borrowing the funds, executing the strategy, and repaying the loan plus fees.

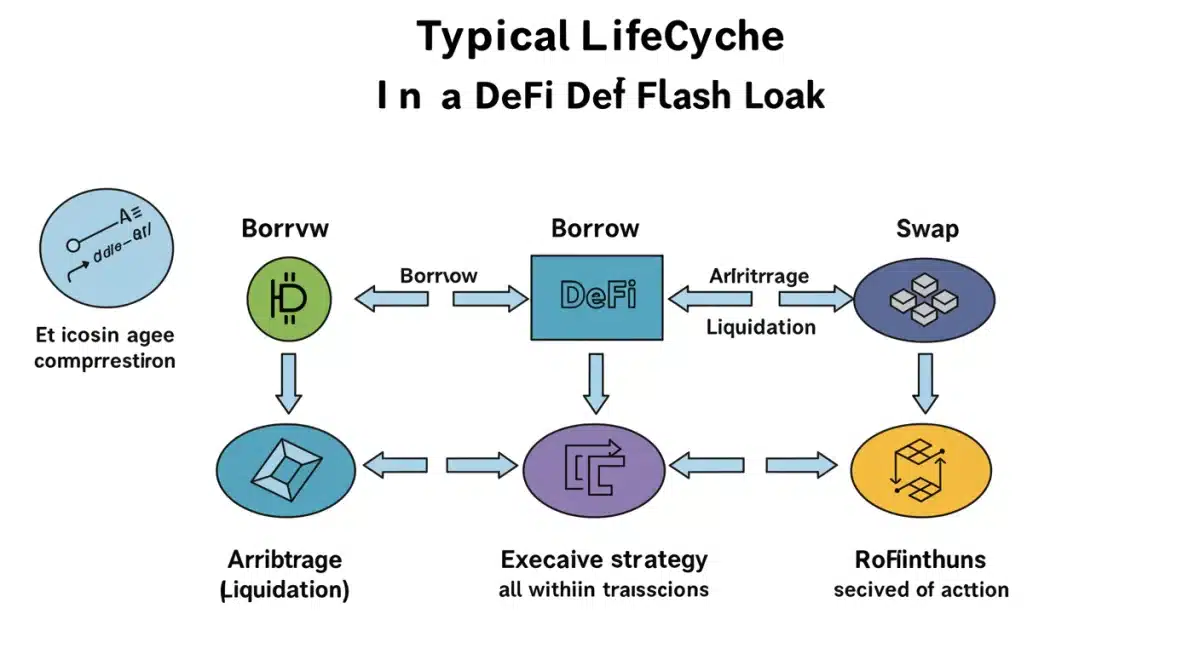

The Flash Loan Lifecycle

The smart contract will typically follow a structure similar to this:

- Borrow Funds: Call the flash loan function of a lending protocol (e.g., Aave, Balancer, dYdX), specifying the asset and amount.

- Execute Strategy: Within the same function call, perform the core operations. For arbitrage, this means executing trades on different DEXs. For liquidations, it’s repaying the undercollateralized debt and claiming collateral.

- Repay Loan: Ensure the initial borrowed amount plus the protocol’s fee is returned to the lending protocol. This is crucial for the transaction to succeed.

- Profit Distribution: If successful, any remaining balance after repayment is your profit, which can then be sent to your wallet.

Testing your contract thoroughly on a testnet with realistic scenarios is non-negotiable. Simulate various market conditions and potential failures to ensure robustness. Finally, deploy your contract to the mainnet and monitor its performance. Automated bots are often used to detect opportunities and trigger these flash loan contracts, enabling rapid response to fleeting market conditions.

Risk Management and Security Considerations

While the potential for high profits is attractive, Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit also involves significant risks that must be carefully managed. The atomic nature of flash loans mitigates risk for the lender, but for the borrower, even a small error in the smart contract logic or an unexpected market shift can result in a failed transaction and lost gas fees, or worse, a successful but unprofitable one if not carefully managed.

One of the primary risks is smart contract vulnerability. A bug in your custom flash loan contract, or even in the underlying protocols you interact with, can lead to exploits or unexpected behavior. Rigorous auditing and testing of your code are essential. Furthermore, gas costs can quickly eat into profits, especially during periods of high network congestion. Inefficient code or poorly timed transactions can turn a profitable opportunity into a net loss.

Mitigating Flash Loan Risks

- Thorough Code Audits: Before deploying any flash loan contract, ensure it has been meticulously reviewed for vulnerabilities and logical errors.

- Gas Price Optimization: Implement strategies to optimize gas usage within your contract and consider dynamic gas price adjustments for execution.

- Slippage and Price Volatility: Account for potential price changes between the time an opportunity is identified and the transaction is executed, especially in volatile markets.

- Oracle Manipulation: Be aware of the risk of oracle manipulation, where attackers can temporarily distort asset prices to exploit flash loan-based strategies.

- Front-Running: Malicious actors can observe pending transactions and attempt to execute a similar, more profitable transaction before yours.

Staying informed about the latest security practices in DeFi and understanding the specific risks associated with each protocol you interact with are crucial. The opaque nature of some smart contract interactions means that due diligence is not just recommended, but absolutely necessary for anyone seriously pursuing flash loan strategies.

Future Trends and Evolution of Flash Loans in 2026

As we look towards 2026, the landscape of DeFi and flash loans is expected to continue its rapid evolution. The strategies for Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit will likely become more sophisticated, driven by advancements in blockchain technology, increased institutional adoption, and regulatory clarity. We can anticipate novel applications and enhanced tools making flash loans more accessible and powerful.

One significant trend will be the integration of flash loans across more Layer-2 solutions and sidechains. As transaction costs on mainnets remain a concern, the ability to execute complex, multi-step flash loan operations on cheaper, faster networks will unlock new possibilities and potentially higher profit margins. This cross-chain functionality will also become critical, allowing flash loans to bridge liquidity gaps between different blockchain ecosystems.

Emerging Flash Loan Innovations

- Cross-Chain Flash Loans: The ability to borrow on one chain and execute operations on another, leveraging liquidity across fragmented ecosystems.

- AI-Driven Strategy Bots: More advanced AI and machine learning algorithms will likely be employed to identify and execute flash loan opportunities with greater speed and precision.

- Decentralized Flash Loan Pools: New protocols specifically designed for flash loan provision, offering more competitive fees and greater liquidity depth.

- Regulatory Frameworks: Increased regulatory clarity, while potentially adding compliance burdens, could also pave the way for institutional participation and further innovation.

The development of more user-friendly interfaces and frameworks for flash loans will also be a key trend. While currently requiring significant technical expertise, future platforms may abstract away much of the complexity, enabling a broader range of users to design and deploy flash loan strategies. However, the core principles of understanding the underlying mechanics and managing risk will always remain paramount for sustained success.

| Key Aspect | Brief Description |

|---|---|

| Instant Liquidity | Flash loans provide uncollateralized access to vast sums of crypto within a single transaction. |

| Profit Strategies | Primarily used for arbitrage, liquidations, and collateral swaps across DeFi protocols. |

| Technical Requirements | Requires smart contract development skills and a robust testing environment. |

| Risk Management | Mitigation of smart contract bugs, high gas fees, and market volatility is crucial for success. |

Frequently Asked Questions About DeFi Flash Loans

A DeFi flash loan is an uncollateralized loan that requires the borrower to repay the funds within the same blockchain transaction it was borrowed. If repayment fails, the entire transaction is automatically reversed, ensuring no loss for the lender. It’s a powerful tool for advanced DeFi strategies.

Profits are typically generated through arbitrage, exploiting price differences across DEXs, or by facilitating liquidations on lending platforms. Collateral swapping and self-liquidating loans are also common strategies. The key is to complete a profitable operation and repay the loan within one atomic transaction.

No, flash loans are unique because they do not require any upfront collateral. The security for the lender comes from the atomic nature of the transaction, where funds are guaranteed to be returned or the transaction is entirely reverted. This makes them highly accessible.

The primary risks include smart contract bugs in your own code, high gas fees eating into profits, price slippage, and potential oracle manipulation. Thorough testing, gas optimization, and understanding market dynamics are crucial for mitigating these risks effectively.

Executing flash loans typically requires smart contract development skills, particularly in Solidity, along with familiarity with development environments like Hardhat or Truffle. While some platforms offer simplified interfaces, direct interaction often involves coding custom smart contracts.

Conclusion

Navigating DeFi Flash Loans in 2026: A Step-by-Step Guide to Profiting from Instant Liquidity for 5% Net Profit reveals a powerful, albeit complex, frontier in decentralized finance. The ability to leverage uncollateralized, instant liquidity for sophisticated financial maneuvers presents unparalleled opportunities for those with the technical acumen and strategic foresight. While the rewards can be substantial, the inherent risks demand meticulous preparation, rigorous testing, and a continuous commitment to understanding the evolving DeFi landscape. As the ecosystem matures, flash loans will undoubtedly continue to play a pivotal role, pushing the boundaries of what’s possible in decentralized finance.