DeFi Governance Tokens: A US Investor’s Guide to the Future of Finance

DeFi Governance Tokens: Participating in the Future of Finance in the US allows investors to actively shape the evolution of decentralized finance protocols by granting voting rights on key decisions and proposals.

Are you looking to influence the direction of decentralized finance? DeFi Governance Tokens: Participating in the Future of Finance in the US offers a unique opportunity to contribute to the evolution of finance itself, so let’s dive in.

Understanding DeFi Governance Tokens

DeFi governance tokens are the key that unlocks participation in the management and development of decentralized finance protocols. Understanding what these tokens are and how they work is crucial for anyone looking to get involved in the future of finance.

What are DeFi Governance Tokens?

DeFi governance tokens are a type of cryptocurrency that gives holders the right to vote on proposals related to the development, modification, or operation of a DeFi protocol. Essentially, they represent a share of the decision-making power within a decentralized autonomous organization (DAO).

How do Governance Tokens Work?

Governance tokens empower holders to propose and vote on changes to the underlying protocol. This includes adjusting interest rates, adding new features, managing treasury funds, and other critical decisions. The more tokens a holder has, the more influence they wield in the voting process.

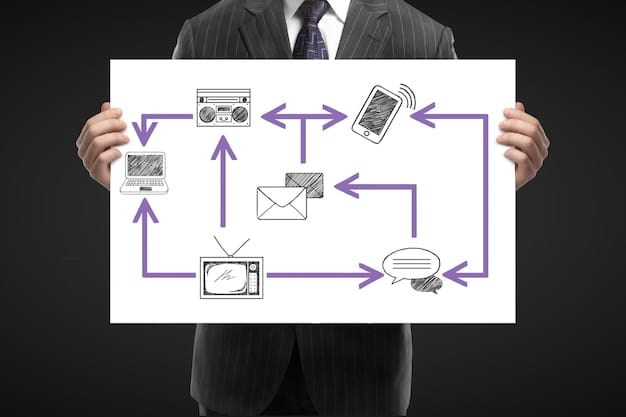

- Proposal Submission: Token holders can propose changes to the protocol.

- Voting Process: Other token holders vote on the proposals.

- Implementation: If a proposal receives enough votes, it is implemented by the protocol.

DeFi governance tokens represent a new paradigm for decision-making. By distributing power among token holders, these tokens foster transparency, community involvement, and resilience against centralized control.

Benefits of Participating in DeFi Governance

Participating in DeFi governance offers several appealing advantages, from influencing protocol direction to potentially earning rewards. These benefits make governance tokens attractive to a wide range of users.

Shaping the Future of DeFi

One of the most significant benefits is the ability to directly influence the future of DeFi protocols. By voting on proposals, token holders can help shape the direction of the project and ensure that it aligns with their interests.

Earning Rewards and Incentives

Many DeFi protocols offer rewards or incentives for participating in governance. This can include earning additional tokens, a share of protocol fees, or other benefits that make governance participation financially attractive.

- Staking Rewards: Staking governance tokens can earn additional tokens.

- Protocol Fee Sharing: Some protocols share a portion of their fees with governance token holders.

- Exclusive Benefits: Access to exclusive features or opportunities within the protocol.

By actively participating in governance, token holders not only influence the direction of the protocol but also have the potential to earn rewards and incentives, creating a mutually beneficial relationship.

Risks Associated with DeFi Governance

While DeFi governance offers considerable benefits, it also comes with its own set of risks. Understanding these risks is crucial for any investor looking to participate in governance.

Governance Attacks and Malicious Proposals

One of the main risks is the potential for governance attacks, where malicious actors attempt to manipulate the voting process to their advantage. This can involve submitting harmful proposals or influencing the vote through various means.

Concentration of Voting Power

Another risk is the concentration of voting power in the hands of a few large token holders. This can lead to decisions that benefit a small group of insiders at the expense of the broader community. To mitigate this, encourage diversified ownership and active participation from smaller token holders.

While these risks exist, they can be mitigated through proper governance mechanisms, community vigilance, and active participation from a diverse range of token holders. Informed participation is crucial in safeguarding the integrity of DeFi governance.

How to Participate in DeFi Governance in the US

Participating in DeFi governance involves several steps, from acquiring governance tokens to actively voting on proposals. This process is accessible to both novice and experienced participants.

Acquiring Governance Tokens

The first step is to acquire the governance tokens of the DeFi protocol you wish to participate in. This can typically be done through cryptocurrency exchanges or by participating in the protocol’s liquidity mining programs.

Registering and Voting on Proposals

Once you have the governance tokens, you’ll need to register with the protocol’s governance platform and actively participate in the voting process. This involves reviewing proposals, assessing their potential impact, and casting your votes according to your preferences.

- Research Proposals: Understand the details and implications of each proposal.

- Assess Potential Impact: Consider the potential benefits and risks of the proposal.

- Cast Your Votes: Use your governance tokens to vote in accordance with your preferences.

Engaging in DeFi governance empowers token holders to exert influence over the project’s future, contributing to its growth while earning incentives. It’s a dynamic process that shapes the trajectory of decentralized finance.

Legal and Regulatory Considerations in the US

The legal and regulatory landscape surrounding digital assets in the US is still evolving, so it’s important to stay informed and be aware of the potential implications for DeFi governance.

SEC Regulations and Compliance

The Securities and Exchange Commission (SEC) has been actively scrutinizing the DeFi space, and it’s possible that governance tokens could be subject to securities regulations. Staying compliant with SEC guidelines is crucial to avoid legal issues.

Tax Implications of Governance Tokens

The tax implications of holding and using governance tokens are also an important consideration. Depending on the specific circumstances, governance tokens may be subject to capital gains taxes, income taxes, or other tax obligations.

Navigating the legal and regulatory landscape is crucial for participants in DeFi governance within the US. Adhering to evolving regulations and seeking professional advice ensures compliance and minimizes potential legal risks.

Future Trends in DeFi Governance

The future of DeFi governance is likely to be shaped by several key trends, including increased decentralization, enhanced security measures, and greater community involvement.

Increased Decentralization and DAO Structures

As DeFi protocols mature, there will be a growing focus on increasing decentralization and transitioning to more robust DAO structures. This will involve distributing voting power more evenly among token holders and empowering the community to play a more active role in governance.

Enhanced Security Measures and Audits

Security is a top priority in the DeFi space, and we can expect to see enhanced security measures and audits implemented to protect against governance attacks and other malicious activities. Regular audits and security reviews will become standard practice to ensure the integrity of DeFi governance.

Anticipating these trends prepares participants to engage with evolving governance structures and technologies effectively. Vigilance, education, and adaptability will be essential in harnessing the power of DeFi governance tokens.

| Key Point | Brief Description |

|---|---|

| 🗳️ Governance Tokens | Enable holders to vote on protocol changes. |

| 🚀 Benefits | Influence protocol direction and earn rewards. |

| ⚠️ Risks | Governance attacks and voting power concentration. |

| ⚖️ Legal | SEC regulations and tax implications in the US. |

FAQ

▼

DeFi governance tokens primarily allow holders to vote on proposals, guiding the protocol’s future decisions and updates.

▼

You can acquire these tokens through cryptocurrency exchanges, participating in liquidity mining programs, or direct purchase from the protocol.

▼

Risks include governance attacks, where malicious actors manipulate votes, and concentration of voting power leading to biased decisions.

▼

Yes, the SEC regulations and tax implications are crucial as the legal landscape for digital assets continues to evolve in the US.

▼

Security audits help protect against governance attacks by identifying vulnerabilities and ensuring the integrity of the voting process.

Conclusion

DeFi governance tokens offer a unique opportunity for individuals in the US to shape the future of finance. By understanding the benefits, risks, and regulatory considerations, investors can actively participate in the development of decentralized protocols and contribute to a more transparent and community-driven financial system.