Altcoin Liquidity Crisis: Identify & Avoid High-Risk Tokens

The altcoin liquidity crisis refers to the challenge of buying or selling altcoins without significantly affecting their price, and this article delves into how to identify and avoid high-risk tokens with low trading volume to protect your investments.

The world of altcoins can be exciting, but it’s crucial to navigate it with caution. One of the biggest risks is the altcoin liquidity crisis: How to Identify and Avoid High-Risk Tokens with Low Trading Volume, meaning it’s hard to buy or sell without drastically impacting the price. This article will help you understand and mitigate that risk.

Understanding Altcoin Liquidity

Liquidity in the context of altcoins refers to how easily you can buy or sell a particular coin without causing a significant change in its price. High liquidity means you can trade quickly and efficiently, while low liquidity can lead to price slippage and difficulty exiting your position.

What is Liquidity?

Liquidity is the lifeblood of any financial market, and altcoins are no exception. It ensures that there are enough buyers and sellers to facilitate trades at reasonable prices.

Why Does Liquidity Matter?

Low liquidity can trap you in a position, making it difficult to sell your coins without taking a substantial loss. It also makes the altcoin more susceptible to manipulation.

- Price Stability: Higher liquidity usually means less price volatility.

- Ease of Trading: Easier to buy and sell without significant price impact.

- Reduced Risk: Lower risk of being unable to exit a position.

Ultimately, understanding liquidity is crucial for making informed decisions in the altcoin market. It can make the difference between a profitable venture and a costly mistake.

Identifying Low-Liquidity Altcoins

Identifying low-liquidity altcoins is a vital skill for any cryptocurrency investor. By knowing what to look for, you can significantly reduce your exposure to potential losses.

Checking Trading Volume

Trading volume is a direct indicator of liquidity. Low trading volume suggests fewer participants, making it difficult to execute large orders without affecting the price.

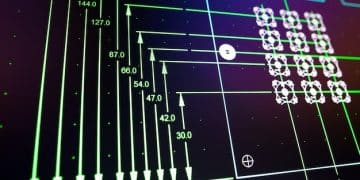

Analyzing Order Books

The order book shows the available buy (bid) and sell (ask) orders for an altcoin. A wide spread between the highest bid and the lowest ask indicates low liquidity.

- Low Trading Volume: Below-average volume suggests limited interest.

- Wide Bid-Ask Spread: Significant gap between buy and sell prices.

- Shallow Order Book: Few orders available at different price levels.

By closely monitoring these indicators, you can identify altcoins with low liquidity and avoid potential pitfalls.

The Risks of Investing in Illiquid Altcoins

Investing in illiquid altcoins comes with several risks that every investor should be aware of. Understanding these risks can help you make more informed decisions and protect your capital.

Price Manipulation

Illiquid altcoins are more vulnerable to price manipulation. A small number of large trades can significantly impact the price, leading to artificial pumps and dumps.

Difficulty Exiting Positions

One of the biggest risks of illiquid altcoins is the difficulty in exiting your position. If there are not enough buyers, you may have to sell at a much lower price than you anticipated.

- Increased Volatility: Sudden price swings due to low trading activity.

- Potential for Scams: Higher likelihood of being targeted by pump-and-dump schemes.

- Loss of Capital: Difficulty selling at a desired price can lead to significant losses.

Being aware of these risks is the first step in mitigating them. Always do your due diligence and consider the liquidity of an altcoin before investing.

Tools for Assessing Altcoin Liquidity

Assessing altcoin liquidity requires the right tools and strategies. Several online resources and analytical techniques can help you gauge the liquidity of an altcoin before investing.

CoinMarketCap and CoinGecko

These platforms provide comprehensive data on cryptocurrencies, including trading volume, market capitalization, and historical price data.

Order Book Analysis Tools

Some exchanges offer tools for analyzing order books, allowing you to visualize the depth of the market and the bid-ask spread.

- Volume Charts: Track trading volume over time to identify trends.

- Depth Charts: Visualize the order book to assess buying and selling pressure.

- Liquidity Scores: Some platforms offer proprietary liquidity scores based on various metrics.

Using these tools can provide valuable insights into the liquidity of an altcoin, helping you make better investment decisions.

Strategies for Avoiding High-Risk, Low-Volume Tokens

Avoiding high-risk, low-volume tokens involves a combination of research, due diligence, and risk management. By following these strategies, you can minimize your exposure to potential losses.

Diversify Your Portfolio

Diversification is a fundamental risk management strategy. By spreading your investments across multiple altcoins, you can reduce the impact of any single illiquid asset.

Set Stop-Loss Orders

Stop-loss orders automatically sell your coins when the price reaches a certain level, limiting your potential losses in case of a sudden price drop.

- Research Thoroughly: Understand the project, its team, and its market potential.

- Start Small: Invest only a small amount that you’re willing to lose.

- Stay Informed: Keep up-to-date with news and developments in the altcoin market.

By implementing these strategies, you can reduce your risk and increase your chances of success in the altcoin market.

Case Studies: Altcoin Liquidity Crises

Examining real-world examples of altcoin liquidity crises can provide valuable lessons for investors. These case studies illustrate the potential consequences of investing in illiquid assets.

Example 1: Token X

Token X experienced a sudden surge in price due to a coordinated pump-and-dump scheme. Investors who bought at the peak were left holding worthless tokens when the price crashed.

Example 2: Coin Y

Coin Y suffered a liquidity crisis when a major exchange delisted it. Trading volume plummeted, and investors struggled to sell their coins at any price.

- Token Z: Experienced a flash crash due to a large sell order that the market couldn’t absorb.

- Coin A: Lost significant value when the development team abandoned the project, leading to a lack of interest and liquidity.

These case studies highlight the importance of liquidity and the risks associated with investing in illiquid altcoins.

| Key Point | Brief Description |

|---|---|

| 🔍 Low Trading Volume | Indicates potential difficulty in buying/selling without price impact. |

| 📊 Wide Bid-Ask Spread | Signals less efficient trading and higher transaction costs. |

| 🛡️ Diversification | Spreads risk across multiple assets, reducing impact of illiquidity. |

| 🛑 Stop-Loss Orders | Automatically limits losses by selling when a price threshold is hit. |

FAQ

▼

Altcoin liquidity refers to the ease with which an altcoin can be bought or sold without significantly affecting its price. High liquidity means easy trading; low liquidity indicates difficulty.

▼

Low liquidity makes it difficult to exit positions, increases price volatility, and makes altcoins more susceptible to price manipulation and pump-and-dump schemes.

▼

Check trading volume on CoinMarketCap or CoinGecko, analyze order books on exchanges, and look for wide bid-ask spreads as indicators of low liquidity.

▼

Stop-loss orders are instructions to automatically sell your altcoins if the price drops to a specified level, helping you limit potential losses from price drops.

▼

Yes, diversification is crucial. Spreading your investments across multiple altcoins reduces the risk associated with any single illiquid or poorly performing asset.

Conclusion

Understanding and avoiding the altcoin liquidity crisis is paramount for protecting your investments in the cryptocurrency market. By identifying low-liquidity tokens and implementing risk management strategies, you can navigate the altcoin landscape with greater confidence and minimize potential losses.