Bitcoin mining profitability 2025: what to expect

Bitcoin mining profitability in 2025 will be primarily influenced by factors such as energy costs, hardware efficiency, market volatility, and evolving regulations that miners must adapt to for optimal returns.

Bitcoin mining profitability 2025 poses intriguing questions for both seasoned miners and newcomers alike. Will the rewards be worth the investment? Let’s explore what to anticipate in the coming years.

Understanding bitcoin mining profitability

Understanding bitcoin mining profitability is crucial for miners who wish to make informed decisions in their operations. This profitability depends on multiple factors that can fluctuate greatly over time. In this section, we will break down the elements that impact how much you can earn from mining.

Factors influencing bitcoin mining profitability

Several key components can determine mining profitability. Here are some significant elements to consider:

- Bitcoin price: The market value of bitcoin affects the revenue from mining. As prices rise, profitability generally improves.

- Mining difficulty: This adjusts approximately every two weeks and directly impacts how hard it is to earn bitcoin. Increasing difficulty means higher resource costs.

- Hardware efficiency: The type and performance of your mining hardware can greatly influence your profits. Choosing energy-efficient hardware can help reduce electricity costs.

- Electricity costs: Since mining consumes a lot of power, the cost of electricity in your location can either enhance or diminish your earnings.

It’s essential to track these variables continuously as they can change rapidly. For instance, when bitcoin prices drop, miners may find it challenging to cover their operational costs. This is why having a strategy in place to adapt to market changes is vital.

Calculating profitability

To determine your mining profitability more accurately, you can use several online calculators that consider all known variables. You simply input your hash rate, electricity costs, and other factors, and they provide an estimate of your earnings.

Additionally, keeping an eye on mining pools can be beneficial. By joining a mining pool, you can increase your chances of earning rewards by combining your resources with others. However, remember that pool fees can also reduce your overall profitability.

Ultimately, understanding bitcoin mining profitability requires a comprehensive view of the market and your personal costs. Regular analysis and adjustment based on these insights will help you optimize your mining operation effectively.

Key factors affecting profitability in 2025

Key factors affecting bitcoin mining profitability in 2025 will be pivotal for miners. As the cryptocurrency landscape evolves, understanding these factors can make all the difference in maintaining lucrative operations.

Market Trends

Bitcoin prices fluctuate greatly, impacting profitability. Staying updated with market trends is essential for anticipating changes. When bitcoin prices soar, miners see increased profits, but during downturns, miners must adapt to remain viable. Market speculation can also influence prices significantly.

Mining Difficulty Adjustments

The mining difficulty level adjusts every two weeks, based on the total hashing power on the network. If more miners join, the difficulty increases, which can squeeze profits. Miners must constantly evaluate their strategies to stay competitive. Keeping up with the changing landscape can help miners plan their operations effectively.

- Tech Innovations: New technology can lower costs and increase efficiency.

- Network Health: A strong network ensures miners earn rewards consistently.

- Legislation: Regulatory changes can impact operations and profitability.

Additionally, energy costs play a crucial role. As mining operations require substantial power, fluctuations in electricity prices can directly affect earnings. Miners located in areas with lower energy costs will have a competitive advantage in maintaining profitability.

Moreover, the choice of mining pool can influence overall returns. By pooling resources with others, individual miners may increase their chances of receiving consistent payouts. However, fees associated with pools must be considered against potential earnings.

In 2025, miners will need to be proactive about these factors to navigate the challenging landscape. Adapting to economic shifts and technological advancements will ensure sustained profitability. Awareness and strategic planning will be the keys to success.

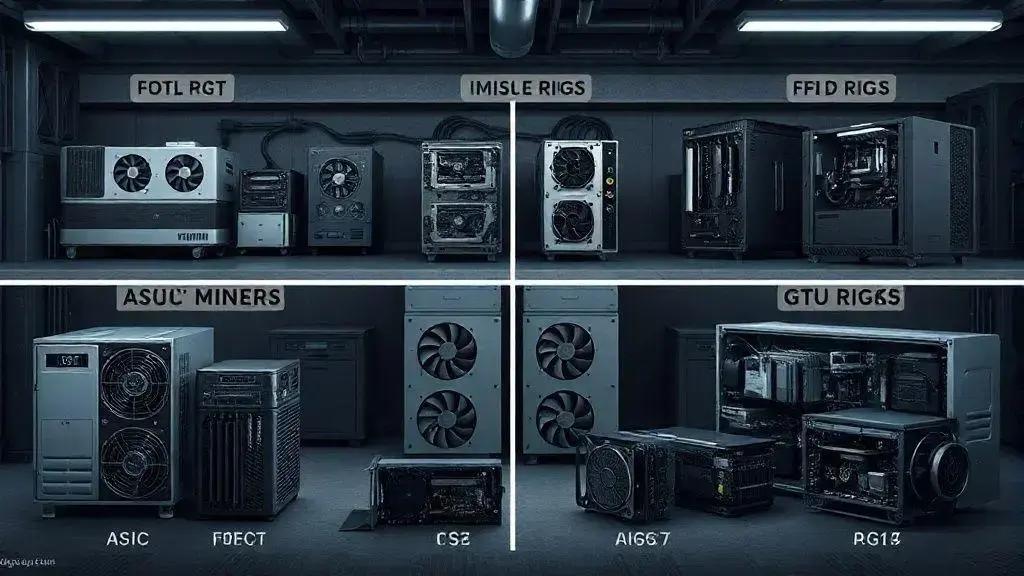

Comparing mining hardware: what’s best for profits?

Comparing mining hardware is essential for maximizing profits in the competitive world of bitcoin mining. With various options available, understanding the strengths and weaknesses of each type can help make the best choice for your mining operations.

ASIC Miners

ASIC (Application-Specific Integrated Circuit) miners are the most popular choice among serious miners. These devices are designed specifically for mining bitcoin and offer high hash rates with low energy consumption. Their efficiency makes them ideal for maximizing profits, but they can be expensive.

GPU Miners

GPU (Graphics Processing Unit) miners are often used by hobbyists and for mining various cryptocurrencies. While they are versatile and can be repurposed for gaming, they are generally less efficient compared to ASIC miners when it comes to bitcoin mining. However, they can still be profitable if electricity costs are low.

- Initial costs: ASIC miners require a higher upfront investment.

- Flexibility: GPU miners can be used for different cryptocurrencies.

- Power consumption: ASIC miners are generally more energy-efficient.

When selecting the right mining hardware, consider the total cost of ownership. This includes the initial investment, electricity costs, and potential resale value. A lower-performing machine may still be profitable with cheaper electricity, while a high-performance ASIC miner may pay off faster due to its efficiency.

Future developments in mining technology should also be on your radar. As hardware continues to evolve, staying updated with trends can help you anticipate changes in profitability. Innovations can lead to lower costs and higher efficiency, making it easier to adapt your mining strategies as the market changes.

In the end, the best choice of hardware depends on your specific situation, including your budget, electricity prices, and long-term plans for mining operations. Evaluating these components will enable you to make an informed decision that enhances your profitability.

The impact of energy costs on mining returns

The impact of energy costs on mining returns cannot be underestimated. For bitcoin miners, electricity is one of the largest operational expenses, often determining whether an operation is profitable or not.

Electricity Pricing

Different regions have varying electricity prices. Miners must analyze local rates to understand how these costs affect profitability. In areas with lower electricity rates, miners can achieve greater returns, allowing them to operate more efficiently. Conversely, high electricity costs can eat into profits, sometimes making mining unfeasible.

Efficiency of Mining Hardware

Using energy-efficient mining hardware is crucial in minimizing electricity consumption. ASIC miners, for example, tend to consume less power per hash compared to GPU miners. Understanding the efficiency ratings of your mining equipment can make a significant difference in lowering costs and improving overall returns.

- Power supply efficiency: Select power supply units (PSUs) with high efficiency ratings.

- Cooling considerations: Adequate cooling systems can help maintain hardware efficiency.

- Renewable energy sources: Exploring solar or wind energy could reduce reliance on traditional power grids.

In addition to hardware choices, the operational strategy also plays a vital role. Miners should adopt strategies to maximize uptime during off-peak energy hours when rates might be lower. This can significantly enhance profit margins by reducing demand costs.

Regulatory factors surrounding energy may also change in the future. Emerging policies favor renewables or might impose taxes on high energy consumption. Keeping an eye on these political changes can help miners forecast potential impacts on energy costs and, subsequently, on mining profitability.

Understanding these dynamics will help miners navigate their expenses and optimize their returns effectively. Careful planning and consideration of energy costs are essential components for anyone looking to succeed in bitcoin mining.

Future trends in cryptocurrency mining profitability

Future trends in cryptocurrency mining profitability will likely shape the industry landscape significantly. As technology and regulations evolve, it will be essential for miners to stay informed about the factors influencing their earnings.

Emerging Technologies

Innovations such as quantum computing and advanced AI algorithms are expected to impact mining efficiency and profitability. Quantum computers could potentially solve complex mathematical problems faster than current computers, which might affect bitcoin mining. As these technologies develop, miners will need to adapt to leverage new tools.

Shifts in Energy Sources

The push for renewable energy sources will likely influence future profitability. As miners look to reduce their carbon footprints, solar and wind energy could become more widely adopted. This shift may lower operational costs in regions with abundant natural resources. Green mining initiatives will not only assist in lowering expenses but can also improve public perception and regulation compliance.

- Incentives for renewable energy: Governments might introduce tax breaks for miners using alternative energy.

- Energy-efficient hardware: New products on the market could enhance performance while consuming less power.

- Decentralization: Miners may shift toward smaller, localized operations to improve energy management.

Additionally, regulation will play a pivotal role in shaping the future of mining profitability. As countries develop frameworks for cryptocurrency operations, compliance will become more critical. Miners must stay alert to changing regulations that could impact costs or operational legitimacy.

Market volatility will continue to be a significant factor. As miners watch cryptocurrency prices, they must prepare for peaks and dips, adjusting their operations accordingly. Keeping informed about market predictions and trends can help miners make strategic decisions that maximize profits.

Adapting to these trends will be vital for miners looking to enhance their profitability. Strategic planning and investment in technology can help ensure success in the ever-changing mining landscape.

FAQ – Frequently Asked Questions about Cryptocurrency Mining Profitability

What are the key factors affecting mining profitability?

Key factors include energy costs, mining hardware efficiency, cryptocurrency prices, and local regulations.

How can renewable energy impact my mining operation?

Using renewable energy sources can lower electricity costs, making your mining operation more profitable.

Why is it important to choose the right mining hardware?

The right hardware affects your mining efficiency, power consumption, and overall profitability.

What future trends should miners watch for?

Miners should watch for advancements in technology, changes in regulations, and shifts in market dynamics that could influence profitability.