Navigating Altcoin Volatility: Strategies to Mitigate Risks

Altcoin Volatility: Strategies for Managing Price Swings and Mitigating Losses involves understanding market dynamics, implementing risk management tools such as stop-loss orders, diversifying investments, staying informed on market trends, and considering the long-term potential of altcoins to minimize financial risks.

The world of altcoins presents exciting opportunities, but also significant risks due to their inherent volatility. Mastering Altcoin Volatility: Strategies for Managing Price Swings and Mitigating Losses is crucial for anyone looking to invest in these digital assets.

Understanding Altcoin Volatility

Altcoin volatility refers to the frequency and magnitude of price swings experienced by alternative cryptocurrencies, known as altcoins. This volatility is generally higher than that of established cryptocurrencies like Bitcoin and can present both opportunities and challenges for investors.

Several factors contribute to altcoin volatility. One primary reason is their relatively lower market capitalization compared to Bitcoin. This makes them more susceptible to price manipulation and significant price swings due to smaller trading volumes.

Factors Influencing Altcoin Volatility

Understanding these influences helps to develop strategies for navigating the altcoin market effectively.

- Market Sentiment: News, social media trends, and overall market sentiment can drive rapid price changes.

- Liquidity: Lower liquidity can cause larger price swings when significant buy or sell orders are executed.

- Regulatory News: Announcements regarding regulations can immediately impact altcoin prices.

Altcoin volatility is an inherent characteristic of these digital assets, stemming from their smaller market caps and susceptibility to market sentiment. Understanding this inherent volatility is the first step in mitigating potential losses.

Risk Management Tools for Altcoins

Effective risk management tools are essential for navigating the volatile altcoin market. These tools help investors protect their capital and make informed decisions based on market conditions.

One of the most fundamental tools is the stop-loss order. This order automatically sells your altcoins when their price reaches a predefined level, limiting potential losses during market downturns.

Implementing Stop-Loss Orders

Setting stop-loss levels requires careful consideration and understanding of each altcoin’s volatility.

- Fixed Percentage: Determine a percentage (e.g., 5% or 10%) below your purchase price to set the stop-loss.

- Volatility-Based: Use the altcoin’s historical volatility to calculate appropriate stop-loss levels.

- Trailing Stop-Loss: Adjust your stop-loss level as the price moves favorably, locking in profits while limiting downside risk.

Risk management tools such as stop-loss orders are crucial for protecting investments in the highly volatile altcoin market. Properly implementing these tools can significantly mitigate potential losses.

Diversification Strategies

Diversification is a cornerstone of risk management in any investment portfolio, and it’s particularly vital in the altcoin market. Spreading investments across multiple altcoins, rather than concentrating them in a single asset, can reduce the impact of individual altcoin volatility.

A well-diversified altcoin portfolio should include altcoins from different sectors, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain infrastructure. This sectoral diversification helps to mitigate risks associated with specific industry trends or regulatory changes.

Staying Informed on Market Trends

The altcoin market is constantly evolving, and staying informed about the latest trends, news, and developments is crucial for making informed investment decisions. Monitoring market trends can help investors anticipate potential price swings and adjust their strategies accordingly.

Various resources can assist in staying informed, including cryptocurrency news websites, market analysis reports, social media channels, and community forums. Combining these resources can provide a comprehensive view of the altcoin market.

Best Practices for Staying Informed

Effective strategies include:

- Follow Reputable News Sources: Rely on established crypto news outlets for accurate and timely information.

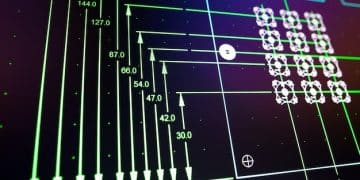

- Analyze Market Data: Use charting tools and analytics platforms to identify trends and patterns.

- Engage with the Community: Participate in forums and social media groups to understand community sentiment and identify potential opportunities.

Staying informed on market trends is a proactive approach to navigating the altcoin market. It enhances decision-making and allows for timely adjustments, mitigating potential risks and maximizing profits.

Evaluating Long-Term Potential

While short-term volatility is a significant concern, evaluating the long-term potential of altcoins is essential for sustainable investment strategies. Identifying altcoins with strong fundamentals and innovative use cases can help investors weather short-term price swings and benefit from long-term growth.

Key factors to consider when evaluating the long-term potential of an altcoin include its technology, team, community, and adoption rate. Altcoins with a solid technological foundation, a dedicated team, a vibrant community, and increasing adoption are more likely to succeed in the long run.

Key Factors for Long-Term Evaluation

When evaluating the long-term potential of an altcoin, consider:

- Technology: Assess the underlying technology for innovation, scalability, and security.

- Team: Evaluate the development team’s expertise, track record, and commitment to the project.

- Community: Analyze the strength and activity of the community supporting the altcoin.

Evaluating long-term potential is essential for navigating altcoin volatility and ensuring sustained investment success. It helps to focus on altcoins with solid fundamentals and long-term growth prospects.

Advanced Trading Techniques

For experienced traders, advanced trading techniques can be employed to manage altcoin volatility and potentially profit from price swings. These techniques require a deep understanding of market dynamics and a significant amount of risk tolerance.

Short selling involves borrowing an altcoin and selling it, with the expectation of buying it back at a lower price in the future. This technique can be used to profit from declining altcoin prices. However, it also carries significant risk, as potential losses are unlimited.

Popular Advanced Trading Techniques

These techniques can be helpful:

- Hedging: Using correlated assets to offset potential losses.

- Arbitrage: Exploiting price differences between exchanges.

- Swing Trading: Capitalizing on short to medium-term price swings.

Advanced trading techniques can be powerful tools for managing altcoin volatility, but they require expertise and a high level of risk tolerance. They should be approached with caution and a comprehensive understanding of market dynamics.

| Key Point | Brief Description |

|---|---|

| ⚠️ Understand Volatility | Altcoins are more volatile than established cryptocurrencies. |

| 🛡️ Use Stop-Loss Orders | Limit potential losses with predetermined sell prices. |

| ➗ Diversify Portfolio | Spread investments across different altcoins. |

| 📰 Stay Informed | Keep up with the latest altcoin market news and trends. |

FAQ

Altcoins are very volatile due to their lower market capitalization, making them susceptible to price manipulation. Market sentiment and regulatory news also contribute to these swings.

Stop-loss orders automatically sell your altcoins when they reach a specified price, limiting potential losses during market downturns. They help manage risk effectively.

Diversification reduces the impact of individual altcoin volatility by spreading investments across multiple assets. This strategy minimizes the risk of significant losses.

Stay informed by following cryptocurrency news websites, market analysis reports, and social media channels. Engaging with community forums is also beneficial.

Assess its technology, team, community, and adoption rate. Altcoins with strong fundamentals and innovative use cases are more likely to succeed long-term.

Conclusion

Navigating the volatile altcoin market requires a combination of understanding market dynamics, implementing effective risk management tools, staying informed on market trends, and evaluating the long-term potential of each altcoin. By adopting these strategies, investors can mitigate potential losses and maximize their chances of success in the world of altcoins.